The Leading Reasons Why Property Owners Choose to Secure an Equity Lending

For many homeowners, picking to protect an equity funding is a calculated financial choice that can use different advantages. The capability to use the equity integrated in one's home can offer a lifeline throughout times of economic need or act as a device to achieve details objectives. From consolidating financial debt to embarking on major home renovations, the reasons driving individuals to choose an equity financing are varied and impactful. Understanding these inspirations can drop light on the sensible monetary preparation that underpins such options.

Debt Loan Consolidation

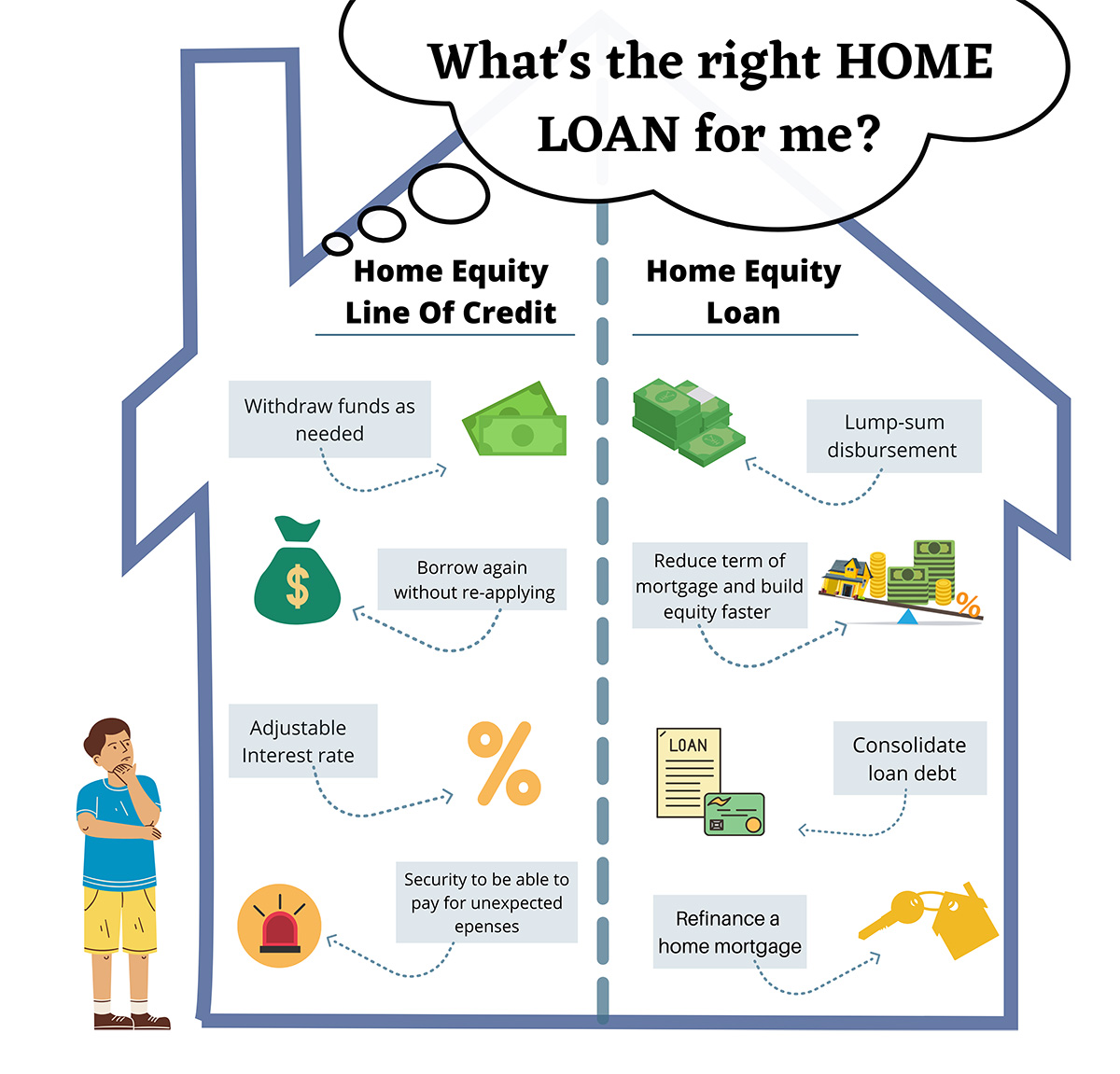

Property owners frequently choose safeguarding an equity financing as a critical monetary step for financial debt consolidation. By leveraging the equity in their homes, individuals can access a round figure of cash at a lower rate of interest compared to other types of loaning. This funding can then be made use of to settle high-interest debts, such as bank card balances or individual loans, allowing property owners to simplify their monetary responsibilities into a single, more convenient regular monthly payment.

Financial debt combination with an equity financing can supply a number of advantages to property owners. Firstly, it simplifies the repayment process by integrating several financial obligations right into one, lowering the threat of missed out on settlements and potential charges. The reduced interest rate connected with equity car loans can result in substantial cost savings over time. Furthermore, combining financial debt in this manner can enhance a person's credit report by lowering their general debt-to-income ratio.

Home Enhancement Projects

Thinking about the boosted worth and functionality that can be accomplished through leveraging equity, many individuals opt to allocate funds towards numerous home enhancement tasks - Alpine Credits copyright. Property owners often choose to safeguard an equity lending especially for remodeling their homes because of the considerable rois that such jobs can bring. Whether it's updating obsolete features, expanding space, or improving power efficiency, home improvements can not just make living rooms extra comfy but also increase the overall worth of the building

Common home renovation jobs funded via equity fundings include cooking area remodels, bathroom renovations, basement finishing, and landscaping upgrades. By leveraging equity for home improvement tasks, property owners can create spaces that better suit their demands and preferences while likewise making an audio monetary investment in their property.

Emergency Expenditures

In unexpected circumstances where immediate financial support is needed, protecting an equity financing can provide property owners with a practical option for covering emergency situation costs. When unforeseen occasions such as clinical emergency situations, urgent home repair services, or sudden job loss develop, having accessibility to funds through an equity loan can supply a safety and security internet for house owners. Unlike other kinds of borrowing, equity car loans normally have reduced rate of interest and longer settlement terms, making them an affordable option for attending to instant economic demands.

One of the vital benefits of utilizing an equity finance for emergency situation costs is the speed at which funds can be accessed - Alpine Credits copyright. Homeowners can promptly use the equity developed in their property, enabling them to address pressing financial issues without delay. Additionally, the flexibility of equity car loans allows property owners to borrow only what they need, avoiding the burden of tackling too much financial debt

Education And Learning Financing

In click this link the middle of the quest of higher education and learning, securing an equity loan can act as a strategic funds for house owners. Education and learning funding is a considerable concern for many family members, and leveraging the equity in their homes can offer a means to access essential funds. Equity car loans often use reduced rate of interest prices compared to various other forms of loaning, making them an attractive choice for financing education and learning expenditures.

By using the equity accumulated in their homes, home owners can access substantial amounts of cash to cover tuition fees, books, lodging, and various other related expenses. Home Equity Loans. This can be specifically useful for parents aiming to support their youngsters through university or individuals looking for to further their very own education. Additionally, the interest paid on equity fundings might be tax-deductible, giving prospective monetary benefits for customers

Ultimately, using an equity lending for education and learning funding can assist people purchase their future earning possibility and career improvement while effectively managing their economic obligations.

Investment Opportunities

Final Thought

Finally, home owners choose to secure an equity car loan for different factors such as financial debt combination, home enhancement jobs, emergency situation costs, education and learning funding, and investment opportunities. These car loans supply a method for house owners to gain access to funds for crucial economic needs and objectives. By leveraging the equity in their homes, homeowners can make the most of reduced passion prices and flexible payment terms to attain their economic goals.

:max_bytes(150000):strip_icc()/dotdash-home-equity-vs-heloc-final-866a2763fd0548eaa393afa0ffd7372b.jpg)